Every day, Portugal attracts more and more foreigners hungry for change. The state maintains a worthy image thanks to its picturesque coastal areas, ecologically clean environment, cultural events, and rich historical heritage. One of the attractive advantages of moving here is Portugal NHR status. The purpose of tax incentives is to attract specialists in various fields, entrepreneurs, and retirees. Such conditions contribute to obtaining a residence permit for many residents of other countries. In particular, investors are considering Portugal because it offers optimal conditions for doing business.

In this article, we will look at how to get it and what benefits NHR status has in Portugal.

Eligibility Criteria for NHR Status in Portugal

Foreign citizens must belong to one of the following categories in order to obtain NHR Status:

- Live in the state for at least six months during the year and own residential property.

- Applicants can become a tax resident after five years of removing their previous status (relevant documentation will be required).

- NHR status allows you to exempt pensions, dividends, and interest from taxes.

- Citizens engaged in scientific, cultural, and artistic activities can use the reduced tax rate.

- Property owners may also be exempt from taxes. However, the property may be subject to council property tax (IMI).

To understand all the nuances of obtaining this status, we recommend contacting Immigrant Invest, a tax specialist whose legal advisers will advise you on all the details. That ensures compliance and understanding of the benefits of NHR status.

Portugal visa for freelancers allows you to receive fees outside the country without being subject to taxes.

Step-by-Step Application Process for NHR Status

Firstly, the foreigner must register as a tax resident of Portugal. The applicant will then be issued a Portuguese tax identification number and will be registered with the local tax office. You must also provide proof of residence, such as a rental agreement or utility bills.

Immigrant Invest specialist Vladlena Baranova emphasizes that the candidate can choose a profession from a list of suitable occupations subject to the specified tax regime, such as:

- representatives of the medical field;

- scientists;

- financial consultants/analysts;

- entrepreneurs;

- IT specialists and software developers;

- teachers.

A citizen can apply for NHR status in Portugal on the website or come to the administrative center and write it there. The main thing is to fill out all the data carefully and accurately. The application is accompanied by documents that Immigrant Invest specialists will help you collect. The package includes:

- a certificate confirming legal income;

- employment contracts;

- pension certificates;

- other relevant documents (marriage certificate, birth certificate, education diplomas).

Once submitted, the tax organization reviews the documents and evaluates eligibility for NHR status. It takes 2-3 months to process.

Foreigners who wish to obtain NHR status in Portugal are required to comply with annual reporting obligations to maintain it.

Key Benefits of Obtaining NHR Status in Portugal

The principal privilege of NHR status in Portugal is benefits. Residents have a fixed rate of 20%.

The Portuguese state has exempted citizens from taxation of their wealth: people who own real estate, investments, or valuables are not required to pay taxes on their accumulated wealth.

Pensioners with NHR status will receive pension without tax income for ten years. It is an ideal offer to make the most of your income while living in a pleasant climate with friendly people.

The resident is also exempt from double income taxation, making Portugal an even more attractive destination for professionals and entrepreneurs from different countries.

The Bottom Line

Since 2009, the program has attracted many experts and foreign investors, offering them favorable tax breaks. Reduced tax rates on various types of income help expand your business and provide retirement income.

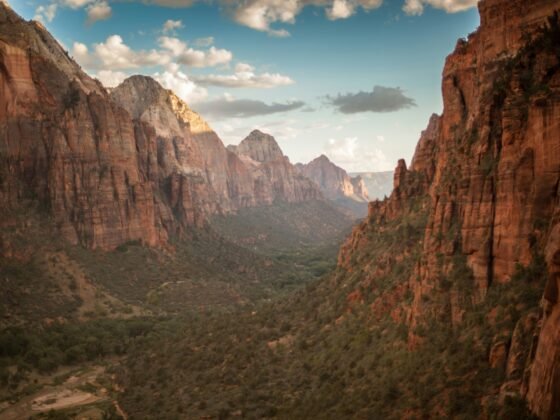

In addition to favorable tax conditions, the state provides a high quality of life. The country, which has a mild climate, rich cultural heritage, historical sites, and beautiful landscapes, offers a lifestyle that combines modern amenities with a relaxed pace of life.

Citizens can benefit from the country’s developed healthcare system, considered one of the best in Europe. The state also offers high-quality education, making it an attractive option for families with children.

You choose a safe and secure future for yourself and your loved ones by choosing Portugal.

Photo by Claudio Schwarz on Unsplash